closed end funds leverage risk

Fund managers are able to use. This leverage can lead to higher returns for investors but it also makes.

Reviewing Leverage Rules Of Cefs Closed End Funds Innovative Income Investor

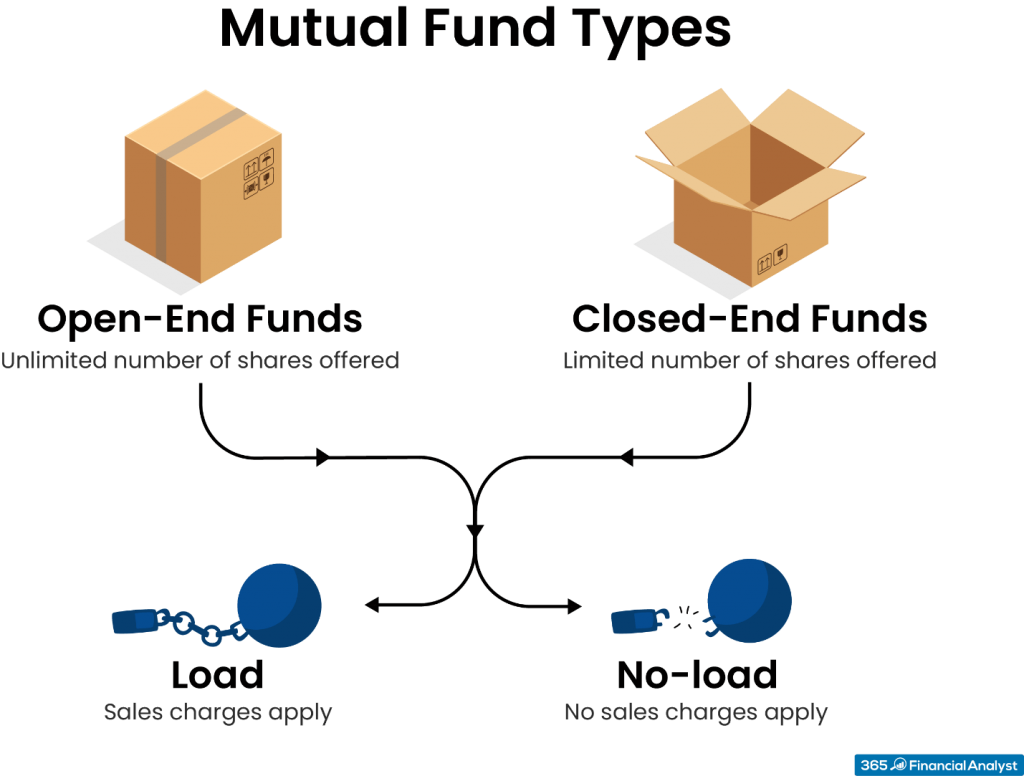

The first closed-end funds were introduced in the US.

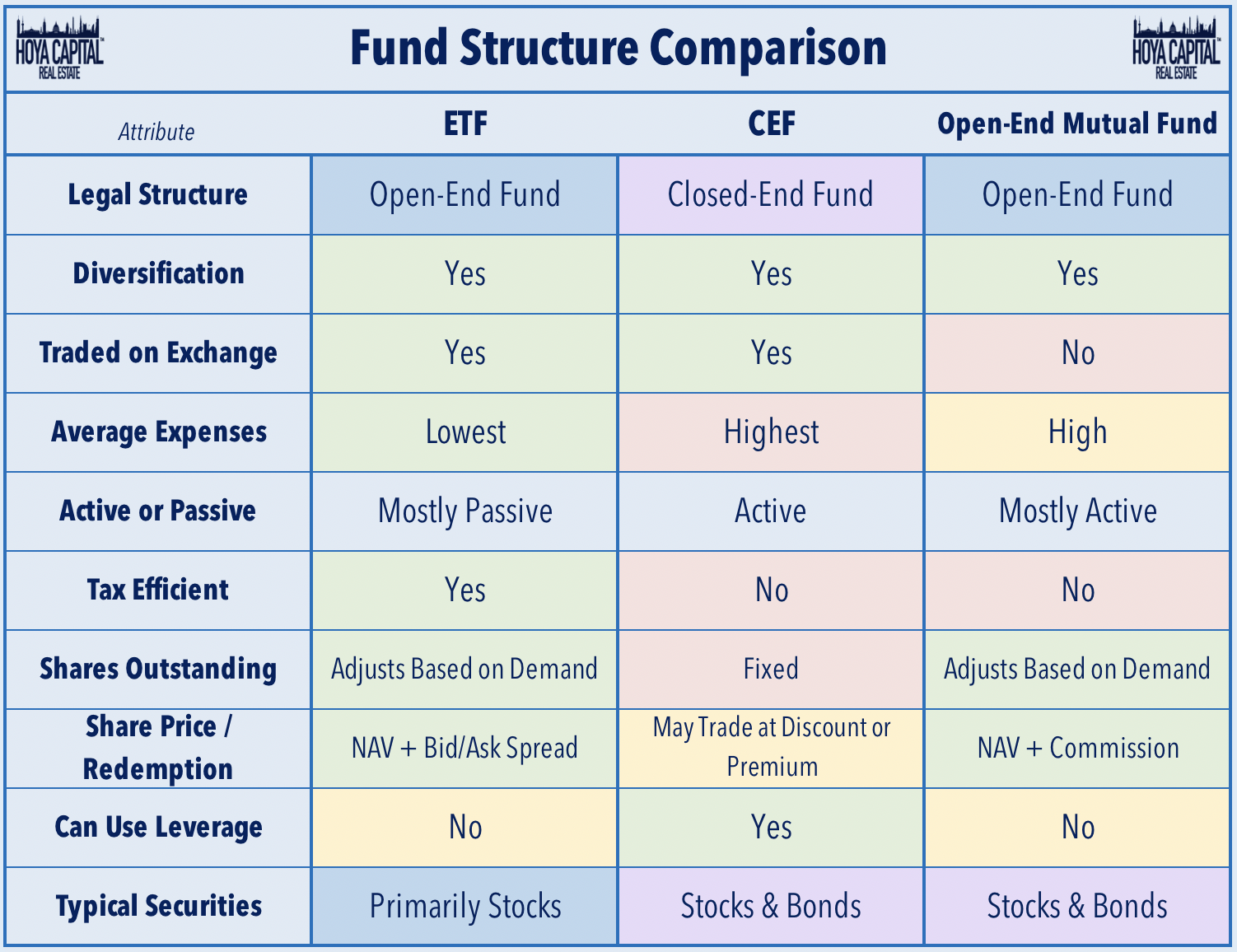

. Most but not all closed-end funds have the ability to use leverage in an attempt to enhance returns. Leverage the ability of closed-end funds to issue debt or raise money through the sale of preferred shares is a unique feature of closed-end funds. A closed end fund is a type of investment company whose shares are traded on the open market.

Closed-end funds may use debt or other leverage more than other types of investment companies to purchase their investments. Most investors think theyre getting a bond fund with these closed end funds but these are not the safety you. Exposure to Leverage or Debt.

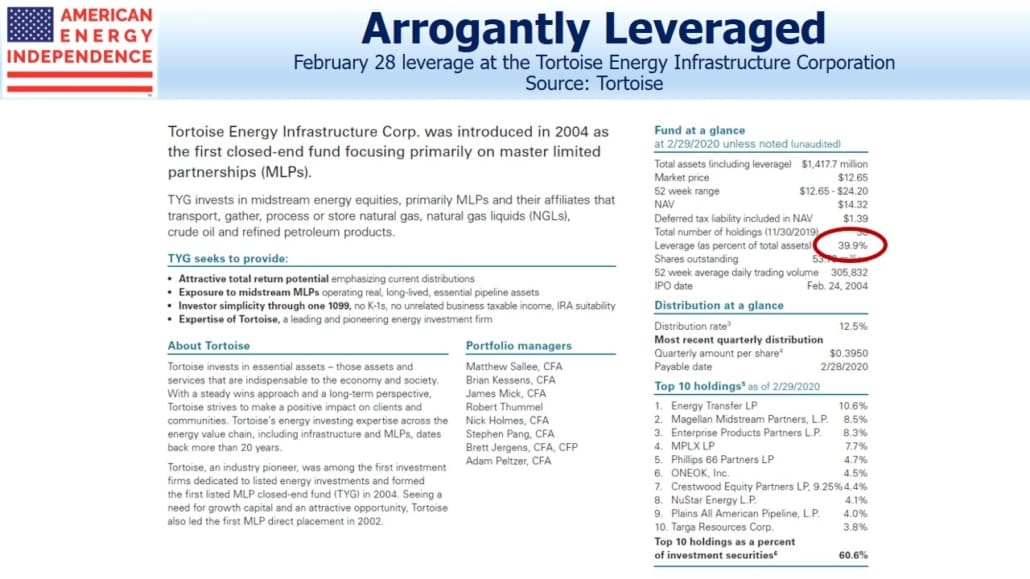

A closed-end fund manager does not face reinvestment risk from daily share issuance. Closed-end funds will generally keep structural leverage between 20 to 40 of the value of its assets. Financial leverage is created whenever closed-end fund common shareholders have investment reward and risk exposure equivalent to more than.

Closed-end funds can offer. What this means for you. There are also non-listed CEFs with continuous subscriptions and regular typically quarterly.

Industry regulations limit the amount of leverage that a fund can assume but. A lot of the funds in the closed-end fund space use leverage. Consider a fund with a 50 percent level of leverage.

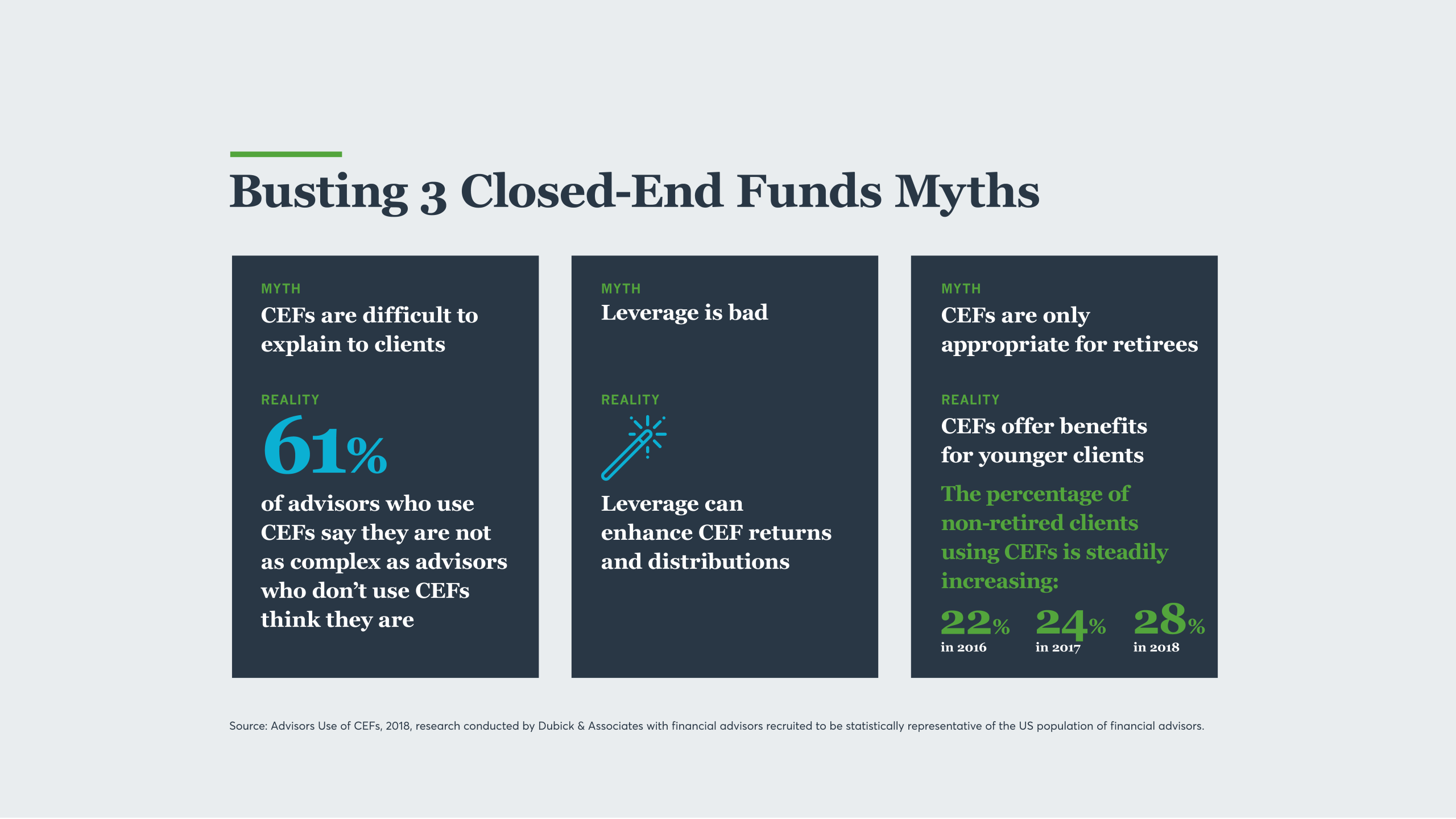

This funding became expensive. Closed-end funds can offer advisers opportunities to introduce clients to successful portfolio managers and strategies at a discount when prices fall. Listed CEFs can offer intra-day liquidity.

It can also increase risk and can make the price of. Leverage increases the volatility of a closed-end funds share price. The term feature ensures NAV liquidity upon maturity.

Investors lost almost 6 in 2018 13 in 2013 and 23 in 2008. Closed-end funds use of leverage can increase your returns but can also increase your losses. What this means for you.

What is Leverage in a Closed-End Fund. Leverage the ability of closed-end funds to issue debt or raise money through the sale of preferred shares is a unique feature of closed-end funds. Closed-end funds have the ability to use leverage which can lead to greater risk but also greater rewards.

Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds. And this was typically historically this has typically been from preferred shares or from debt. If the funds assets drop by 20 percent in value the.

Before the financial crisis closed-end bond funds could access relatively cheap short-term funding through auction-rate preferred securities ARS.

Real Estate Cefs Satisfying A High Yield Fix Seeking Alpha

:max_bytes(150000):strip_icc():gifv()/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

How A Closed End Fund Works And Differs From An Open End Fund

Understanding Leverage In Closed End Funds Nuveen

Closed End Funds Education And Insights Blackrock

5 Best High Yielding Closed End Funds To Buy

What Is The Difference Between Closed And Open Ended Funds Quora

Closed End Funds From All Angles

What Are Mutual Funds 365 Financial Analyst

A Leverage Lesson In Municipal Bond Closed End Funds

How Closed End Funds Can Help You Differentiate Your Firm And Attract And Retain Clients

The Virus Infecting Mlps Sl Advisors

Understanding Leverage In Closed End Funds Nuveen

/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

How A Closed End Fund Works And Differs From An Open End Fund

Key Concepts Of Closed End Funds Nuveen

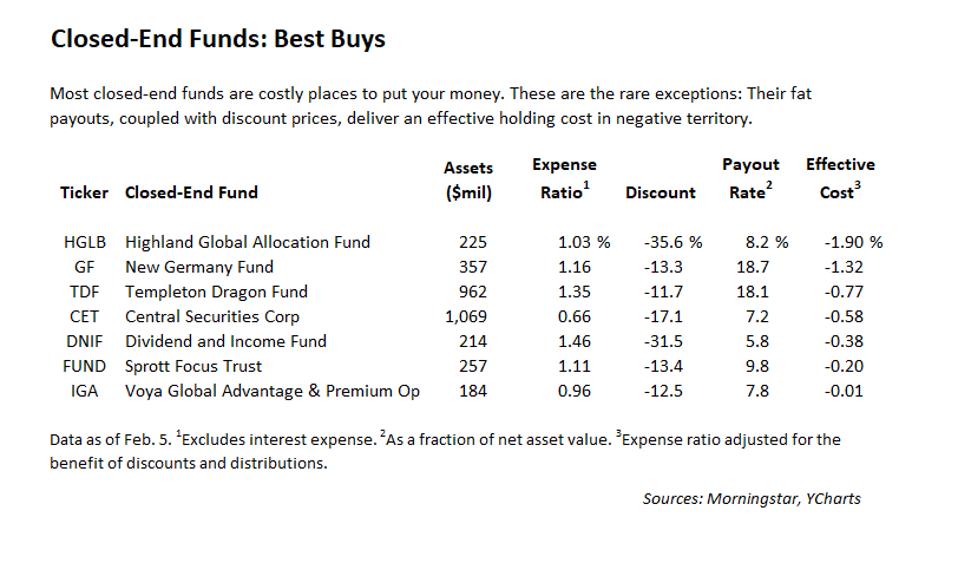

Guide To Closed End Funds Best Buys

What Are Mutual Funds 365 Financial Analyst

Lecture 4 Mutual Funds Ppt Download

A Lesson On Leverage In Municipal Bond Closed End Funds Vaneck